According to available statistics, production capacity of the waterborne barrier board in China is close to 2,000 tons per month in 2023, which is a significant increase compared to the 800 tons per month last year. However, such capacity only accounted for a tiny proportion in China’s paperboard industry. Water-based barrier board in China is mainly for food packaging, and mainly sells to overseas market. Whether it will sustain a healthy growth in the future largely depends on the policy choices at home and abroad.

From where we stand, here are the key trends of water-based barrier board.

Customers nowadays are no longer satisfied with average barrier quality. They are looking for tailored solutions to enable optimal packaging performance in different applications. The board should be liquid and grease resistant with tailored properties such as lower moisture vapor transmission rate (MVTR) or lower oxygen transmission rate (OTR), which are required in demanding end-uses. For example, OTR, as lowest as 0.02 cm3/m2/day so far, is preferred in dried fruit packaging. Likewise, powder materials packaging requires a low MVTR. Traditional acrylic dispersion can only provide MVTR values between 100 to 200g/m 2 /day, but High Performance Barrier (HPB) dispersion can offer a MVTR value lower than 50g/m 2 /day or even 10g/m 2 /day.

A gradual switch to HPB from plastic has been witnessed by increasing use of HPB board at industrial level. Unlike food packaging which is highly safety-conscious, industrial packaging emphasizes barrier performance and production cost. HPB packaging can be divided into industrial bulk packaging and daily chemical product packaging. Industrial bulk packaging refers to all kinds of valve sacks that are used to hold granular materials, such as cement and chemical powders. Paper valve sacks are usually available at the sizes of 25 kg or 50 kg. Water-based barrier, as a sustainable alternative to plastic, can guarantee heat sealability and MVTR value to best support packing performance of paper valve sacks in high-speed production. Pioneering companies that are promoting the development of HPB products include Alou, BASF, and Covestro. HPB can provide a desirable barrier performance but its benefit also has trade-offs. Production cost is one of the obstacles of its market growth. Daily chemical product packaging refers to packaging of products such as detergent, shampoo, and skin care, most of which are bags of several hundred grams to two kilograms. Daily chemical product packaging is more demanding in terms of barrier performance than valve sacks. It requires critical properties such as humidity control, airtightness and light protection.

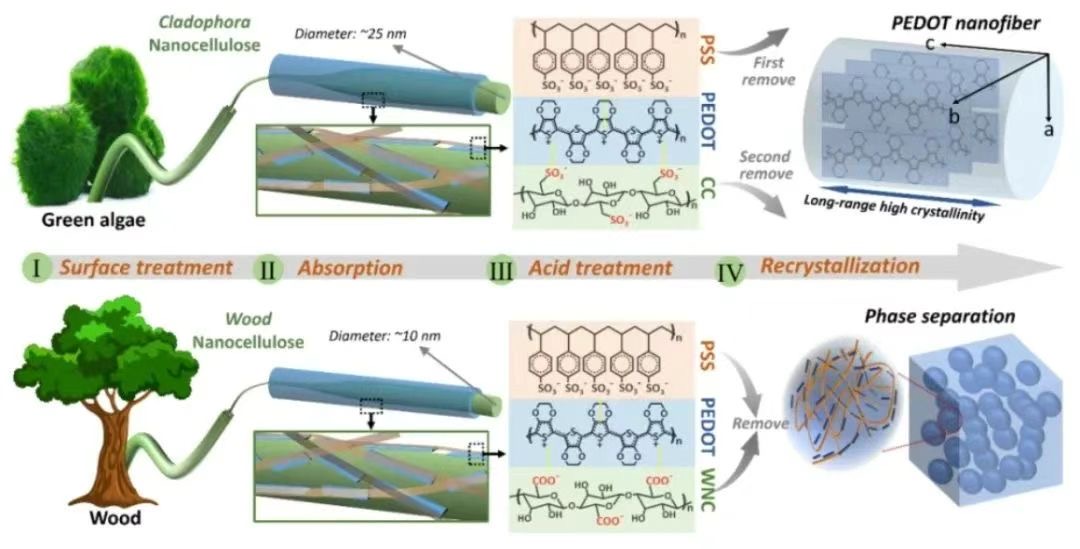

Given the fact that plastics is not biodegradeable, renewable materials are viewed with favor by eco-conscious customers and brands, the most populous of which are bio-based barriers. For over a year, a few manufacturers have launched their own bio-based dispersion products, promoting application in various industries, especially the food packaging industry. From barrier dispersion to printing inks, the bio-based content of product ranges between 30% and 90%. The introduction of nanocellulose materials further diversified the portfolio of bio-based barriers. Companies that are offering biodegradable coatings include Basf, Covestro, Siegwerk, Wanhua, Shengquan, Qihong, Tangju and etc. The development of nanocellulose materials in the global market is still in its infancy. Researches have been taking place in many applications and industries, including papermaking, coatings, daily chemicals and energy batteries. However, most researches are considered superficial at this stage, further in-dept study and investigations are clearly needed. Theoretical research and practical application need to be in closer collaboration with each other. Study and investigation should go beyond Cellulose Nanofibrils (CNF) or Microfibrillated cellulose (MFC), so as to provide more options for customers to choose the one that can best support their packaging requirement.

80% of the demand of sustainable barrier product comes from China's overseas markets, such as Europe, North America and Australia. Demand of water-based barrier board in Australian market has grown significantly over the past years. Plastic restriction policy in Hong Kong has also contributed to the growth of water-based barrier board. Its domestic demand in China is relatively weak at the moment. The development of aqueous dispersion coating not only relies on brands’ efforts but also on industry policy. Over the past year or so, local authorities in China have changed from promoting biodegradable plastic to diversified plastic-free alternatives, especially recyclable and renewable materials.

Post time: Apr-19-2024